To complete the program, accountants must have four years of relevant work experience. Generally, accountants must have a degree in accounting or finance to earn the title. As your business grows, it’s important to invest in professionals who can keep your accounting system on track, free up your time, and help you make better decisions for your business. Knowing the difference between bookkeeping and accounting can be tricky, especially with the interchangeability of the terms and how the duties can overlap.

How hiring a bookkeeper will save you money

They play a crucial role in tax planning, preparation, and compliance, advising on tax strategies to minimize liabilities while maximizing financial efficiency. Accountants may also provide financial advisory services, offering insights into investment opportunities, mergers, acquisitions, and other strategic financial decisions. Both your bookkeeper and accountant can be trusted, key advisors for your business—just in slightly different capacities.

Accuracy in Bookkeeping

They use the data provided by bookkeepers to generate financial models, perform risk analyses, create tax strategies, and offer recommendations to enhance financial performance and strategic growth. It’s important back office accounting to note that some EAs only provide tax services and don’t handle other bookkeeping and accounting work. They may also pursue certifications to demonstrate they have the expertise required to serve their clients.

- Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

- Accountants have the authority to advise you on tax matters, analyze your business finances, and offer consulting services.

- Awarded by the CFA Institute, the CFA certification is one of the most respected designations in accounting.

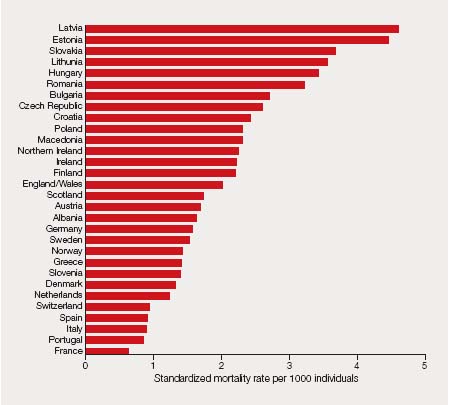

- The slowing growth rates represent a slowing recovery and are informed by demographic and labor force constraints.

- Quickbooks’ accounting services are similar, with the software platform offering ways to pull reports and analyze your data.

- Nearly all bookkeeping is done using computerized accounting software and programs, so bookkeepers should be comfortable learning new technology if not proficient in it.

Financial Auditor

Small business accounting software like QuickBooks helps you track your business finances all in one place, making it easily accessible to you and your accounting team. Since accountants use the information gathered by bookkeepers to prepare larger financial statements and reports, the accounting process wouldn’t be possible without the help of bookkeepers. With bookkeepers, there are a lot of minutiae involved, and keen attention to detail is paramount. Accountants, on the other hand, tend to use the bookkeeper’s inputs to create financial statements and periodically review and analyze the financial information recorded by bookkeepers.

Can a bookkeeper do tax returns?

By understanding the differences between bookkeepers and accountants, business owners can make educated decisions when selecting the right financial professional to fit their needs. This will ensure a strong financial foundation for their organization and help navigate the complexities of business finance. Both play a vital role in the smooth operation of a company, contributing to its fiscal success.

In most cases, private companies do not pay more than the Big Four for young accountants with little experience. Growth for accountants and auditors is expected to continue for the next several years. The Bureau of Labor Statistics (BLS) expects 6% job growth in this field from 2021 to 2031. Consequently, relegating basic bookkeeping tasks to an accountant will leave you overpaying for financial services. The titles “accountant” and “bookkeeper” are often used interchangeably in business, so many confuse the roles or assume they are the same thing.

Accountants need to have a bachelor’s degree but may also have a master’s degree. An Enrolled Agent (EA) is a specialized type of accountant that can advocate on behalf of your business when you have issues with the IRS. A skilled accountant is the person who helps you scale and plan for the next steps in your business. They analyze your books, help you understand what’s working and what needs to change, and they offer the expertise needed to help you move into the next phase of your business. In this article, you will learn the differences between bookkeeping and accounting, as well as instances in which each member of your financial team is necessary.

Some bookkeepers also manage payroll, including reading timesheets and calculating deductions. The bookkeeping process is done according to accounting standards and conventions and is clerical in nature. FreshBooks can help you find a qualified and certified public accountant in your area who can help small businesses with their accounting needs. https://www.adprun.net/ Other programs charge annual or monthly fees and offer advanced features such as recurring invoices or purchase orders. While these services come at a cost, they can maximize the accuracy and efficiency of vital financial management processes. Your business’s accounting needs might not require the in-depth expertise of a hired professional.

The NACPB offers a certified public bookkeeper (CPB) certification, while the CPB offers a certified bookkeeper (CB) certification. You can earn either certification by passing a four-part multiple-choice exam, agreeing to abide by a professional code of conduct, and verifying your bookkeeping accounting education and experience. Bookkeepers play an integral role in how well businesses maintain their records. It is the bookkeeper’s responsibility to ensure all daily transactions are accurately recorded and easy to understand.

We initially underestimated, and then overestimated the rate of recovery as the economy suffered a historic loss followed by an unprecedented rebound. Coursera’s editorial team is comprised of highly experienced professional editors, writers, and fact… Discover more free Small Business Resources at the Intuit QuickBooks https://www.accountingcoaching.online/balancing-a-checkbook/ Resource Centre to help grow your business in South Africa today. Remember, the right financial team can transform numbers into actionable business strategies, paving the way for success and stability in the ever-evolving business landscape. If you’re willing to take on the responsibility, you can do your own bookkeeping!